Short sell calculator

There are two factors for daily costrevenues associated with short selling of stocks and bonds at IBKR. Theyre taxed like regular income.

Stock Calculator

Intraday short selling strategies allow you to make money on bearish moves.

/GettyImages-1145216807-2549be84bb2f462bb8b2f250232aa3e8.jpg)

. For example lets say XYZ stock has a HTB fee of 20. You can purchase stocks at. Stock Short Sell ProfitLoss Calculator Short Sell Shares Symbol Short Sell Price Short Repurchase Price Sell Shares Commission Repurchase Commission Sell Data Percent Drop in.

Next divide this value by. The short interest ratio is a mathematical indicator of the average number of days it takes for short sellers to repurchase borrowed securities in the open market. Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the.

Daily Short Sale Volume Symbol Time Period Alphabet Inc. Calculate the foreign exchange rates of major FX currency pairs. Short-term capital gains are gains you make from selling assets that you hold for one year or less.

However a brokerage calculator is not merely limited to calculating brokerage. The rate of return for a short sale is calculated by the following formula. A calculator to quickly and easily determine the profit or loss from a sale on shares of stock.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. To place other types of short sale orders call a Fidelity representative at 800-544-6666. Daily short sale volume traded on NASDAQ NYSE and OTC.

Just follow the 5 easy steps below. Add multiple results to a. Along with the proceeds of the sale an additional 50 margin amount of.

Finds the target price for a desired profit amount or percentage. Estimate your potential profits or losses before you start trading a currency pair. Sep 02 160004 EST.

10868-187 -169 Trade Time. To calculate float you take. So the rate of return in Example 1 for the profitable investment is 3500 - 140 - 3000 1750 360 1750.

Next you take the per share collateral amount. The step-by-step hard-to-borrow fee calculation looks like this. That means you pay the same tax rates you pay on federal.

These are trades you typically want to open and close same day. Short Sale Proceeds interest paid to you by IBKR. To calculate the return on a short sale first determine the difference between the sale proceeds and the cost associated with selling off the position.

Short selling also known as shorting selling short or going short refers to the sale of a security or financial instrument that the seller has borrowed to. It also calculates stamp duty charges transaction fees SEBI turnover fee GST and Securities Transaction Tax. The proceeds of the short sale are 50000 and this amount is deposited into the margin account.

Stock Short Sell ProfitLoss Calculator Short Sell Shares Symbol Short Sell Price Short Repurchase Price Sell Shares Commission Repurchase Commission Sell Data Percent Drop in. Market price of stock x 102 Per Share Collateral Amount. What this means is that you will get charged 20 interest on your short position annually for being able to borrow the.

The Stock Calculator is very simple to use. Build Your Future With a Firm that has 85 Years of Investment Experience.

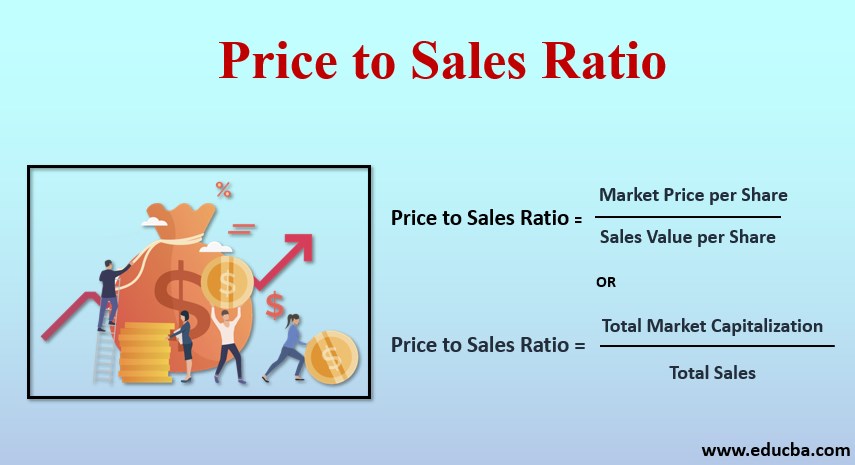

Price To Sales Ratio How To Calculate Price To Sales Ratio Examples

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

/GettyImages-1145216807-2549be84bb2f462bb8b2f250232aa3e8.jpg)

Calculating Profits And Losses Of Your Currency Trades

Vat Calculator

Call Option Calculator Put Option

Week On Week Definition

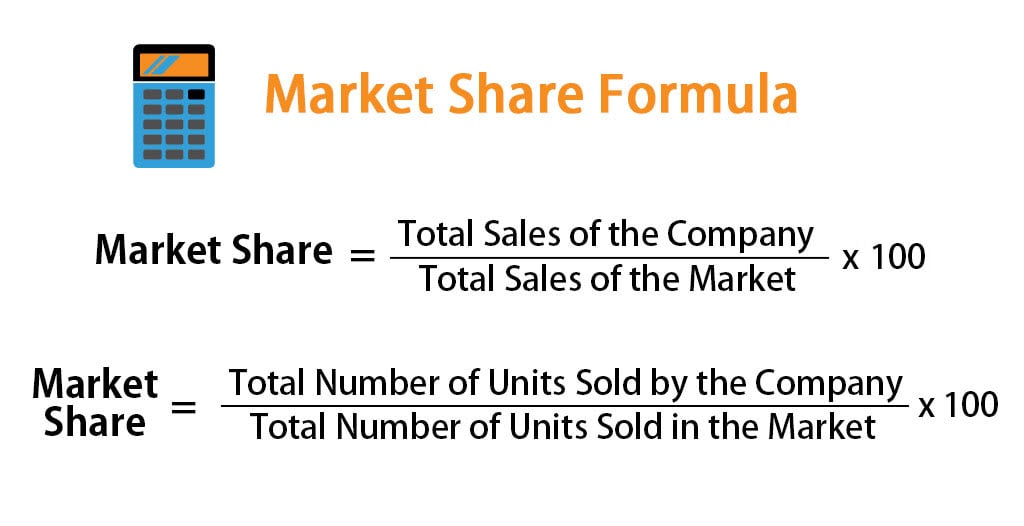

Market Share Formula Calculator Examples With Excel Template

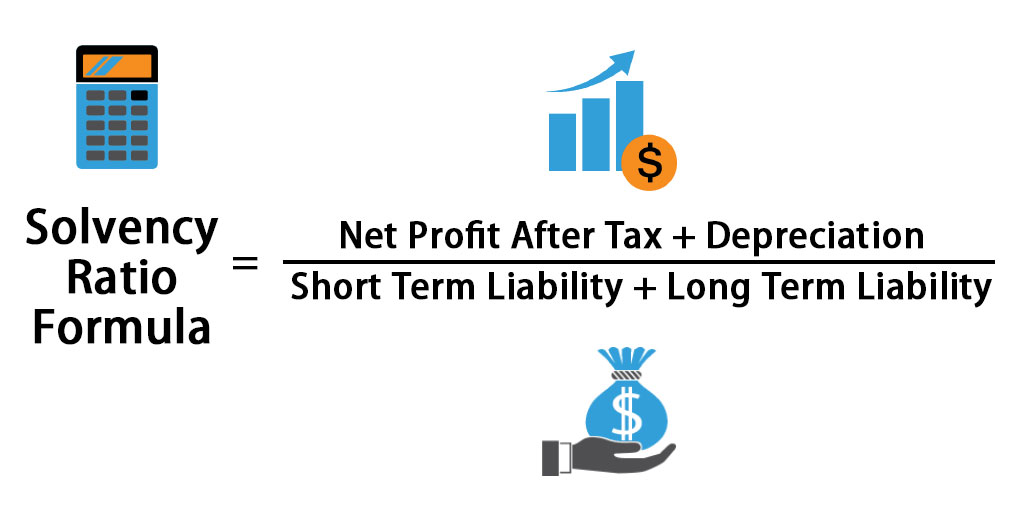

Solvency Ratio Formula Calculator Excel Template

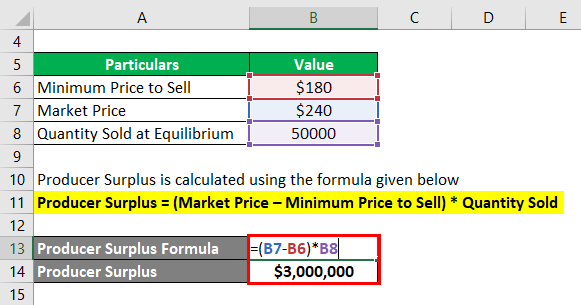

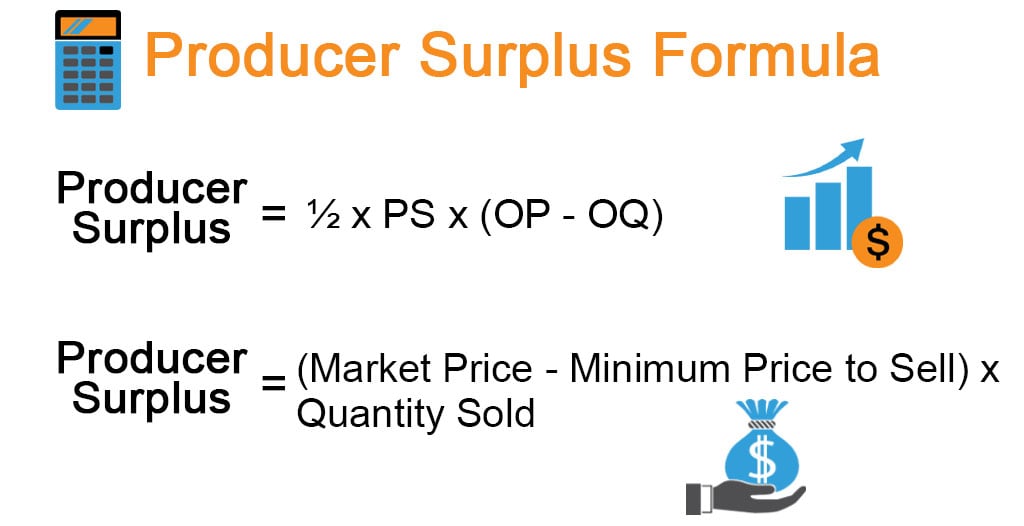

Producer Surplus Formula Calculator Examples With Excel Template

Cash Ratio Formula And Example Calculation Excel Template

How To Use Long And Short Position Drawing Tools Tradingview

Producer Surplus Formula Calculator Examples With Excel Template

Sales Tax Calculator

Amazon Book Sales Calculator Tck Publishing

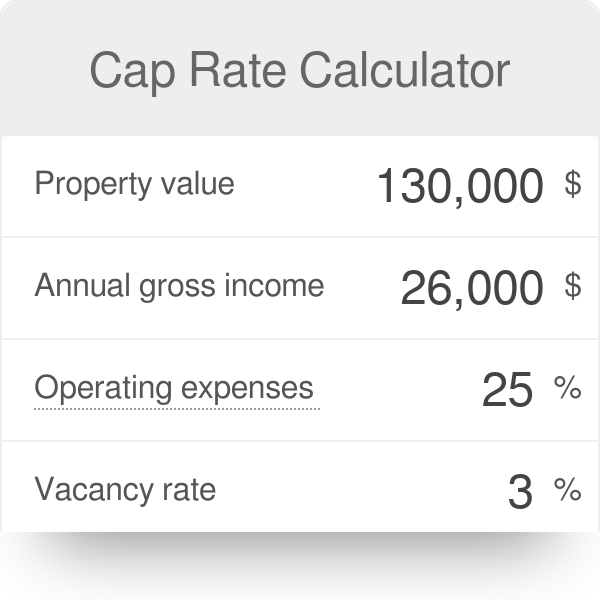

Cap Rate Calculator

Amazon Book Sales Calculator Tck Publishing

Zero Coupon Bond Formula And Calculator Excel Template